Housing Market Update March 2025: How Low Will Mortgage Rates Go?

Get The Latest OC Housing Report

We will get back to you as soon as possible.

Please try again later.

Economic and Housing Market Update: What’s Happening in March 2025?

Mortgage Rates Hit a Four-Month Low

One of the biggest movers in the market right now? Mortgage rates. As of March 6, 2025, rates have dropped to their lowest levels in four months, hovering around 6.5% to 6.875% for well-qualified borrowers (depending on the loan type—conventional, FHA, or VA). This is down from 7.25% in January—a nearly 0.75% decline that’s sparking action. We’re seeing a surge in purchase applications and refinancing activity as buyers and homeowners seize the moment. For context, a year ago, rates were about 0.375% to 0.5% higher than today, per Mortgage News Daily. Josh noted, “Short-term momentum might push rates up slightly, but the longer-term trend still looks like a gradual decline.” Volatility’s the name of the game, though—more on that later.

Inventory Update: A Mixed Bag

Nationwide, active housing inventory ticked down slightly this week to 639,485 single-family homes—about 1,000 fewer than last week’s 640,000. That’s still 28.3% more than this time last year (around 500,000 homes), which is great news for buyers craving options. But compare it to 2015’s 962,000 homes, and we’re still well below historical norms.

Locally, here’s what we’re seeing:

- Orange County, CA: Inventory rose 3.58% to 3,239 properties (single-family homes, condos, townhomes—everything included).

- Huntington Beach, CA: Down 1.38% to 217 homes.

Nationally, markets like Dallas, Denver, Jacksonville, Nashville, and Phoenix are showing positive inventory growth compared to 2019 (think 5%+ increases), while places like Virginia, Rhode Island, and Illinois remain deeply negative (some down 80% from 2019 levels).

New Listings and Price Cuts

Unsold new listings dropped for the second week in a row to 53,000 properties—still slightly above last year’s figure. With rates easing, Josh and I expect this to unlock more inventory as spring approaches. Sellers who were on the fence might list sooner, especially with months of supply creeping up in places like Miami (over 10 months), San Antonio, Jacksonville, and Nashville (around 5 months).

Price cuts? They’re at 33.7% of listings and trending upward. Historically, this rises through September/October as more homes hit the market and competition heats up. Josh asked a great question: “Why do price cuts increase later in the year when buying season kicks off?” My take: more inventory means more competition, and not every home sells at asking price—especially if it’s overpriced to start. Even a $1 reduction counts as a “cut,” so the data can exaggerate the trend.

Home Sales and Prices

Pending home sales this week? Median price hit $389,900—up 2.6% year-over-year. Sales volume jumped 7% week-over-week but is still 3% below last year’s pace. New single-family home sales started at 60,000—a solid number signaling builder confidence.

Economic Indicators: Jobs, GDP, and Tariffs

- ADP Jobs Report: A preview of Friday’s non-farm payrolls showed just 77,000 jobs added—below the expected 140,000. It’s still growth, but sluggish. Josh noted, “The market doesn’t trade ADP heavily—it’s Friday’s numbers that matter.” Expectations are for a light report, which could keep rates stable unless it’s a shocker.

- Atlanta Fed GDP Now: This volatile tracker plummeted from 2.1% to nearly -3% in days. It’ll moderate as more data rolls in, but it’s a red flag tied to tariff uncertainty. Josh said, “We haven’t seen a drop like this in years—something to watch.”

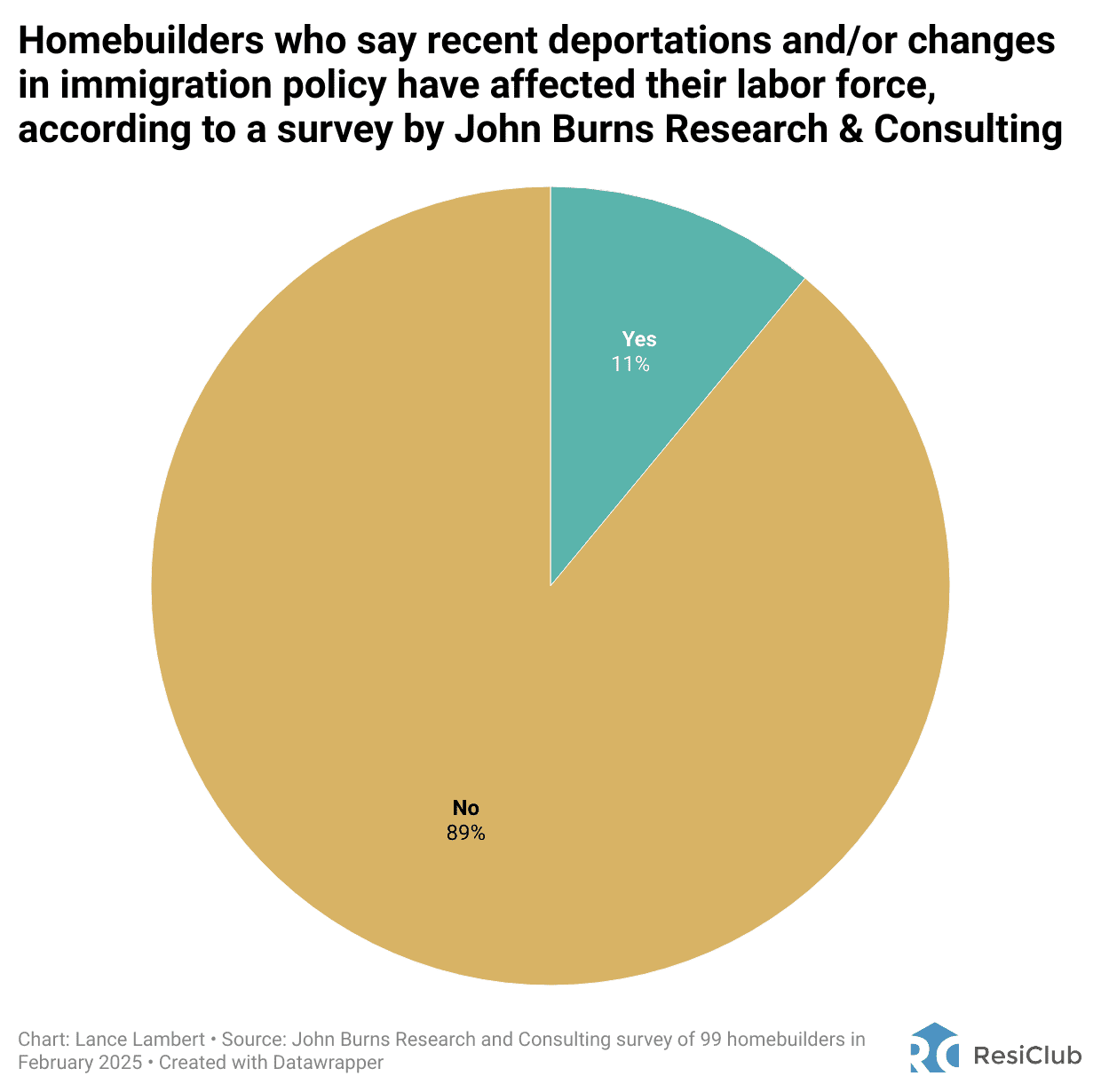

- Tariffs and Immigration: Homebuilders report 89% see no labor impact from deportations yet (current figures are under 10,000). Tariffs, though, are in effect now and could spike lumber prices—a bigger worry for construction costs.

<="" ul="">

<="" ul=""> Stock Market Wealth and Caution

Here’s a wild stat: U.S. households now hold more wealth in stocks as a percentage of total assets than ever before ( see chart from the show ). That’s great when markets soar, but Josh warned, “A 50% drop takes a 100% gain to recover. Be defensive—don’t set it and forget it.” Meanwhile, Warren Buffett’s cashing out, signaling caution. Uncertainty’s high—tariffs, employment, GDP—it’s a lot to digest.

Q&A: Your Top Real Estate Questions Answered

You all came out swinging with some fantastic questions during the live show! We’ve distilled them into a sharper, more actionable Q&A section. Whether you’re buying, refinancing, or just curious, here’s the expert scoop—straight from Josh and me.

Is It a Buyer’s or Seller’s Market in SoCal? (Caesar, Southern California)

Question: “Owners of good homes won’t negotiate—is it a buyer’s or seller’s market?”

Answer: Caesar, who just snagged a home and closed a refi, nailed it with flexibility—looking at a wide range of properties and sticking to his budget. In Southern California, it’s not a clear buyer’s or seller’s market; it’s property-specific. Prime homes hold firm, but more options (up 28.3% year-over-year nationally) give buyers leverage if they’re strategic. Congrats, Caesar!

Should I Lock My Rate with a 45-Day Closing? (Joshua Johnson)

Question: “Closing in 45 days—lock now or float?”

Answer: With 45 days, volatility’s your enemy—rates could rise a quarter or dip an eighth. Josh says, “Spikes happen faster than drops,” so locking now brings peace of mind. If rates fall later, refinance. Better safe than sorry on this timeline.

Best Rate Now or Higher Rate for a Free Refi Later? (Brett)

Question: “Should I take the best rate now or a higher rate for a no-cost refi later?”

Answer: For a purchase, I’d lock in the best rate without points—don’t tie up cash in uncertainty. Josh adds, “Lender credits rarely cover all purchase costs, but a no-cost refi (higher rate, fees covered) can work down the road.” Run the numbers—every deal’s different.

Can I Refi Without a Mortgage Statement? (Anonymous)

Question: “What if I don’t have a mortgage statement?”

Answer: No problem! Josh says, “Send us your HELOC or loan details—we’ll pinpoint your goals and target rate.” Join our Rate Watch —we’ll monitor rates for you, no statement required.

Refinancing Without Cash Upfront? (Mary)

Question: “Can I refi without a down payment?”

Answer: Absolutely—if you’ve got equity or go no-cost (higher rate, lender covers fees), you’re in the clear. Josh explains, “It’s all about loan-to-value—no cash needed.” Sweet deal!

Is 6.5%, 10% Down, No MI a Good Offer? (Degenerate Learner)

Question: “Credit union offered 6.5%, 10% down, no mortgage insurance, $7K closing costs—is this solid?”

Answer: 6.5% is competitive, and dodging MI with 10% down (likely conventional, great credit) is a win. Josh cautions, “$7K might include prepaids—check the breakdown.” Hit us up at jebsmith.net/start for a second opinion.

Refi a 7.9% Rate Now? (AR)

Question: “At 7.9%, should I refi ASAP?”

Answer: Yes—7% is within reach, even for non-QM loans. Josh advises, “Above 7.5%, explore options, but small loans might not justify closing costs.” Let’s crunch it for you!

Cash-Out Refi After Buying with Cash? (Jonathan)

Question: “Seasoning period for a cash-out refi on a cash-bought home?”

Answer: If it’s all your cash, Fannie Mae lets you refi instantly (delayed financing rule). Otherwise, wait 6 months (conventional/VA) or 12 (FHA). Josh: “Prove it’s yours, and you’re set.”

When to Abandon Refi Hope at 6.625%? (Dave, Ohio)

Question: “Bought in 2023 at 6.625%—when do I give up on refinancing?”

Answer: Don’t quit—numbers tell the tale. You missed September’s 5.875% dip, but Josh suggests a 25-28 year term to align with your payoff. Options exist—don’t sleep on it.

FHA Loan with Back Child Support? (OS)

Question: “Can I get an FHA loan owing back child support?”

Answer: Yes, with a payment plan and 3-6 months of payments. Josh: “Same applies to alimony or taxes—consistency is key.”

Lock a Rate Before Finding a Home? (Grace)

Question: “Can I lock a rate before a contract?”

Answer: Some lenders offer 60-day “lock and shop” deals—rates are higher, though. Josh: “Unless rates are surging, wait. No property, no commitment if it falls apart.”

Loan to Convert a Home to a Duplex? (Eric)

Question: “Can I borrow to turn a single-family home into a duplex?”

Answer: Yep—FHA 203(k) or Fannie Mae Homestyle Renovation loans cover it. Josh: “Structural changes take time and bids, but it’s doable.”

Locked at 6.25%—What Now? (Anonymous)

Question: “Closing March 14, locked at 6.25%—next steps?”

Answer: Sit tight—6.25% is a steal! Josh: “You’re golden—just coast to closing.”

Buy in 2026 with 5% Down? (First-Time Buyer)

Question: “5% down by 2026—buy or wait?”

Answer: No crystal ball for 2026 rates, but I say buy when life’s stable—don’t chase the market. Drop us a line; we’ll keep you posted.

Refi 7.5% to Save $300/Month? (Jansen)

Question: “Can I refi 7.5% to save $300 monthly?”

Answer: Josh: “Big loan ($800K)? Yes. Small ($200K)? Tougher. Let’s run it at jebsmith.net/start.” Numbers don’t lie!

Wait for Jobs Report to Lock? (Joe)

Question: “Should I wait for Friday’s jobs report to lock?”

Answer: Tough call—Josh predicts a muted reaction; I think a weak report could nudge rates down slightly. Risk-averse? Lock now. Gambler? Wait it out.

FHA Loan for a Fixer-Upper? (Marcus)

Question: “Can I use an FHA loan for a fixer where the seller won’t repair?”

Answer: Yes—FHA 203(k) or Homestyle Renovation. Josh: “It’s complex—needs pros and patience.”

Rolling a Solar Loan into a Mortgage? (SF Miners)

Question: “Can I add a solar loan to my mortgage?”

Answer: Usually no—it’s part of your down payment unless it’s an energy-efficient loan. Josh: “Compare rates—it might cost more.”

Buy a First Home in 2025? (LJ, Michigan)

Question: “Should I buy in 2025 if I can afford it?”

Answer: If you’re stable (job, finances), yes—don’t time rates. Josh: “Tariffs might drop rates, but not everyone wins.”

Using Rental Income for Another Property? (Anonymous)

Question: “Can rental income offset a new purchase?”

Answer: Not gross rent—net profit after taxes/expenses. Josh: “$500/month positive? That counts.”

Are Refis Cheaper Than Purchases? (Jonathan)

Question: “Do refinances cost less than purchases?”

Answer: Yes—lower fees, more negotiable. Everywhere.

USDA Loan Interest-Only on Land? (OS, Michigan)

Question: “USDA loan—interest-only on land during construction?”

Answer: No free lunch—interest rolls into your mortgage. Josh: “USDA construction loans are rare and tricky.”

When Do Lender Fees Hit? (First-Time Buyer)

Question: “When do I pay lender or broker fees?”

Answer: Josh: “We’re paid at closing—credit reports or appraisals might be upfront, but no consultation fees.”

Non-QM Loan Episode Coming? (OS)

Question: “Will you do a non-QM loan episode?”

Answer: Yes—within 4 weeks! Think bank statement loans, DSCR. Josh: “Use brokers, watch prepay penalties.”

FHA with a Big Down Payment? (LJ)

Question: “Should I use FHA with a large down payment?”

Answer: Maybe—FHA cuts payments, conventional cuts loan size. Josh: “Let numbers decide.”

Loan on Social Security Alone? (Orange Blossom)

Question: “Can I get approved with just Social Security?”

Answer: Yes—if it’s steady (3+ years). Josh: “No job? No issue.”

Buy Down Rate with 5-Year Recoup? (Anonymous)

Question: “Worth buying down a rate if it takes 5 years to break even?”

Answer: Josh: “No—sunk costs tie you up unless you’re 100% sure.” Flexibility matters.

Red Flags on a 1970s Brick Home? (LJ)

Question: “What inspection red flags for a 1970s brick home?”

Answer: Focus on big-ticket items: roof, HVAC, plumbing, electrical, foundation. Age and replacement costs are your guide.

Final Thoughts

What a night! From mortgage rates dipping to inventory shifts and your stellar questions, this episode was a goldmine. My parting advice? Don’t chase the market—focus on your goals and let the numbers guide you. Josh’s take? “Talk to a few pros—top 5% lenders and realtors make all the difference.”

Missed us live? Catch the replay on The Educated Home Buyer Podcast every Friday, or join us Wednesdays at 5 PM PST. Got a question? Hit jebsmith.net/start —we’re here to help, nationwide.

If this added value, give it a thumbs-up, share it with a friend, and let’s keep the conversation going. Until next week—happy house hunting!

Jeb Smith

The Educated Home Buyer Live

714-376-2711 | jeb@jebsmith.net | lICENSE # 01407449

2130 Main St, #290 | Huntington beach ca 92648

All information provided is deemed reliable but is not guaranteed and should be independently verified. This website and its affiliates make no representation, warranty or guarantee as to accuracy of any information contained on this website. You should consult your advisors for an independent verification of any properties or legal advice.